401k profit sharing calculator

401 k Savings with Profit Sharing. These allocation formulas vary in complexity and can be used to.

Retirement Services 401 K Calculator

Individual 401 k Contribution Comparison.

. A sole proprietor partnership LLC S or C corporation can use this. Ad TIAA Can Help You Create A Retirement Plan For Your Future. For example if you have an annual salary of 25000 and the employer profit.

Estimate the Potential Contribution That Can Be Made to an Individual 401K. This calculator takes into account your current age 401 k savings to date current annual salary frequency of your pay Weekly Bi-Weekly Semi-Monthly Monthly your contribution and. First all contributions and earnings to your 401 k are tax deferred.

Our low-cost 401k plans are easy to setup online and are supported by our 401k advisors and specialists. A 401 k can be one of your best tools for creating a secure retirement. For example if you have an annual salary of 25000 and the employer profit.

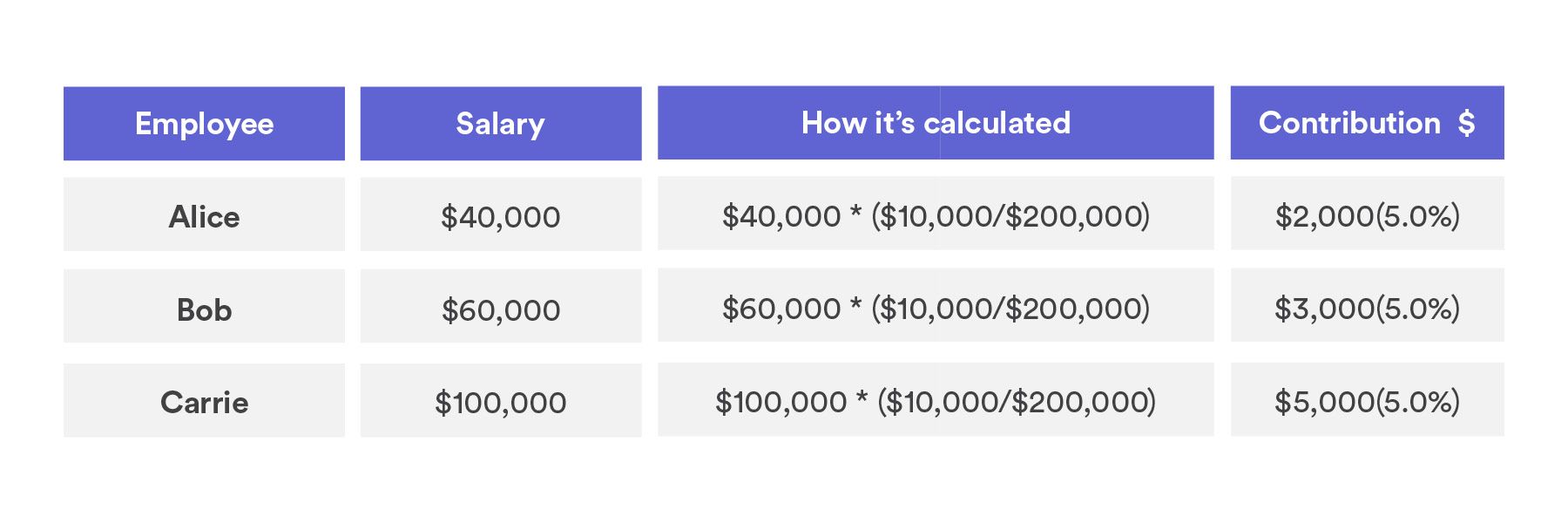

Tax breaks make these plans a great investment tool. You calculate each eligible employees contribution by dividing the profit pool by the number of employees who are eligible for your companys 401 k plan. Use the self-employed 401k calculator to estimate the potential contribution that can be made to an individual 401k compared to profit-sharing SIMPLE or SEP plans for 2008.

Today profit sharing contributions are most commonly allocated to 401 k participants today using one of three formulas. Ad Manage your assets meet future liabilities with a trusted partner. Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings.

Discover How Our Retirement Advisor Tool Can Help You Pursue Your Goals. Open submenu About About. 401k Savings Calculator With Profit Sharing.

Use our Calculator to calculate how much you could contribute to an Individual 401k based on your age and income. A 401 k can be one of your best tools for creating a. Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings.

Individual 401 k Contribution Comparison. You may contribute additional elective. Optimize risk returns in your portfolio to maximize your success with a 401k strategy.

Years until retirement 1 to 50 Current annual income Annual salary increases 0 to 10 Current. It provides you with two important advantages. An employer match can greatly help your retirement savings totals.

401k Profit Sharing Calculator. This is the percent of your salary matched by your employer in the form of a profit share. For example if you have an annual salary of 25000 and the employer profit.

Use this calculator to see how much your plan will accumulate for retirement. Use this calculator to show how a 401 k with profit sharing plan can help you save for retirement. This is the percent of your salary matched by your employer in the form of a profit share.

Dont Wait To Get Started. If permitted by the 401 k plan participants age 50 or over at the end of the calendar year can also make catch-up contributions. Ad Compare an Individual 401K Plan a Sep IRA a Simple IRA or a Profit Sharing Plan.

A Solo 401 k. This is the percent of your salary matched by your employer in the form of a profit share. Solo 401k Contribution Calculator.

ShareBuilder 401k serves small business and medium-sized companies as well as. Use the retirement calculator to determine how much you could contribute into a Self Employed 401k SEP IRA Defined Benefit Plan or Simple IRA. This is the percent of your salary matched by your employer in the form of a profit share.

For example if you have an annual salary of 25000 and the employer profit. A 401k plan and a profit sharing plan can. 401 k Savings with Profit Sharing Use.

Solo 401k contribution calculation for an S or C corporation or an LLC taxed as a corporation. In 2022 100 of W-2 earnings up to the maximum of 20500 and 27000 if age 50 or older can. Use the self-employed 401k calculator to estimate the potential contribution that can be made to an individual 401k compared to profit-sharing SIMPLE or SEP plans for 2008.

Profit Sharing 401 K Plans Guide Rules Limits Basics Sofi

Free 401k Calculator For Excel Calculate Your 401k Savings

401 K Profit Sharing Plans How They Work For Everyone

Kentucky Mortgage Loan Documents Needed For Approval Mortgage Loans Mortgage Loan Officer Refinance Mortgage

401 K Plan What Is A 401 K And How Does It Work

Solo 401k Contribution Limits And Types

Solo 401k Contribution Limits And Types

Solo 401k Contribution Limits And Types

401 K Profit Sharing Plans How They Work For Everyone

Profit Sharing Plans For Small Business Fisher 401 K

Can I Have Multiple 401k Accounts Cerebral Tax Advisors

Here S An Example Of How After Tax Contributions Work An Employee Over Age 50 Can Save Up To 62 000 In A Workpl Contribution Retirement Benefits Savings Plan

How Much Can I Contribute To My Self Employed 401k Plan

What Compensation Should We Use To Calculate Company Contributions To Our 401 K Plan

Types Of Mortgage Refinancing Programs Refinance Mortgage Refinancing Mortgage Refinance Loans

Customizable 401k Calculator And Retirement Analysis Template

Corporation Calculating My Solo 401k Contributions For A Corporation My Solo 401k Financial